Diese Seite richtet sich an unsere amerikanischen Klienten.

This site we provide for our american clients.

General Informations:

Video about the law-firm Albrecht (download):

MPEG Video-Datei [44.3 MB]

- The Taxcase (Sofa - Tesa)

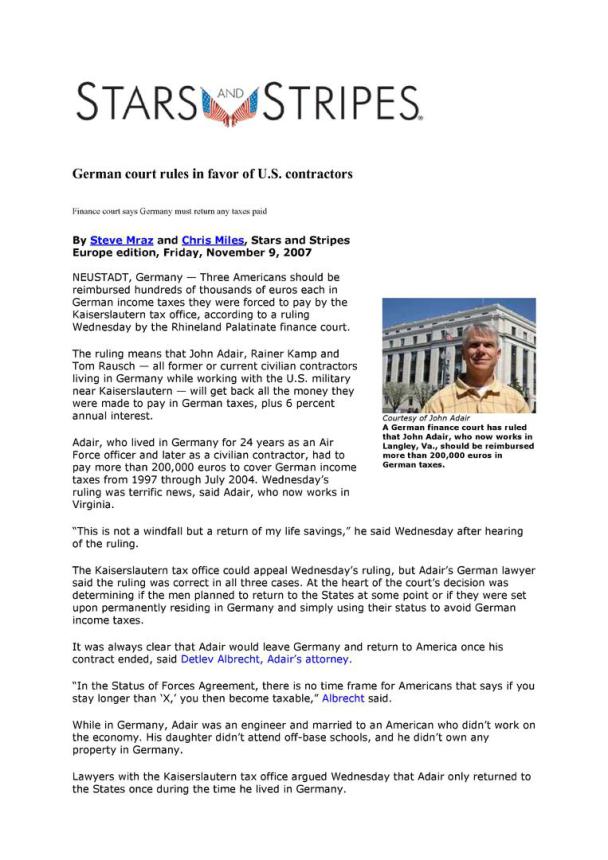

Finance court says Germany must return any taxes payed.

- The final decision

Letter to the Editor Stars & Stripes:

I am delighted to advise that there was a highly favorable outcome in the tax trial in Neustadt.

The case involving John Adair vs. the Kaiserslautern Finanzamt has now been clearly and firmly decided in John Adair's favor.

The K-Town Finanzamt will be required to return the $300k that Mr. Adair was required to pay in taxes...plus the Finanzamt must also, under German law, pay 6% interest for each year that it held the

money. (The sweetener is that no taxes are payable on any of these funds to include the interest.)

My favorite German lawyer (Mr. Detlev Albrecht) has now set a precedent which was reportedly described by one local official as "a black day for German taxation."

Mr. Albrecht was alone in the court while there were 8 lawyers and tax officials representing the Kaiserslautern Finanzamt.

A key element was the notion that length of time in Germany should not play into any decision to tax...and also that Article X was being interpreted too liberally by the Finanzamt.

Mr. Albrecht advised that several U.S. military & civilian lawyers were in the court to include senior representatives from USAREUR and USAFE. There were also two reporters from Stars &

Stripes.

A clear precedent has definitively been set and I would expect any law-abiding DOD contractor with TESA certification to be reasonably protected from German taxation. However, I am sure there will be

other cases...and each will need to be judged on its own merits.

My hat is off to Mr. Albrecht who has served U.S. interests above and beyond what one might expect from the German legal and taxation systems.

I expect we'll be hearing more about this later...but, for now, I'm delighted we can finally put one in the win column.

Joseph Theodore Page Jr., Böblingen

Latest Case:

‘This is discrimination’: Germany seeks income taxes from US airman because he's married to local woman

By JOHN VANDIVER | STARS AND STRIPES Published: April 2, 2020

STUTTGART, Germany — Tax authorities are demanding a Ramstein-based airman pay German income taxes because he is married to a local woman, setting up a potentially precedent-setting case that could have financial implications for scores of U.S. troops in the country.

The move levies double taxation on an airman who already pays U.S. income taxes and potentially threatens service members who marry Germans or take any number of steps to integrate into life outside the base gates.

There are now 387 tax cases involving U.S. Defense Department personnel in the greater Kaiserslautern area, home to the most U.S. troops in Germany, local tax officials told Stars and Stripes.

It’s unclear how many of those cases involve active-duty personnel, but some service members are now considered viable tax targets, tax officials said.

“It is true that the Rheinland-Pfalz tax offices levy taxes on U.S. soldiers who are married to a German spouse if their income is subject to German tax liability,” said Peter Leismann, a spokesman for the Kusel-Landstuhl finance office.

But the circumstances German authorities say are taxable, despite the NATO Status of Forces Agreement’s general exemptions for U.S. forces from foreign income taxes, have grown substantially in recent years.

Master Sgt. Matthew Larsen in Ramstein was informed by the Kusel-Landstuhl tax office in December that his SOFA exemption is no longer recognized.

Larsen filed taxes in the U.S. while his wife, Kathrin, legally filed separately in Germany. On a questionnaire, she wrote that her husband was a service member.

Larsen said a worker at the Kusel-Landstuhl tax office told him his marriage to a German is an indication he is in the country for reasons other than his job and that this obligates him to pay German income tax.

“I am here on orders. I am literally ordered to be here. But they are saying that, because I am married to a German, my SOFA status is irrelevant,” said Larsen, who has been based at Ramstein since 2015. “This is discrimination. They are going to be going after a lot of other people and this has to stop.”

Larsen’s tour in Germany ends in August, after which he said he plans to retire from the Air Force and move to Florida.

That hasn’t stopped German tax authorities, who demanded Larsen provide a declaration of income for back taxation, something that he is resisting and could have to fight in court.

“We have a wave of Americans getting harassed from the side of the German IRS and it is getting worse and worse,” said Detlev Albrecht, a Kaiserslautern-based German tax attorney who is handling about 50 cases involving American military personnel locked in battles with German tax authorities.

Larsen, who is Albrecht’s only active-duty client, said he was forced to retain an attorney to avoid a 10,000 euro fine, or about $11,000, and the prospect of prison time for refusing to turn over documents. The hope is for the courts to dismiss the case, Larsen said.

When orders aren’t enough

In recent years, German tax offices have grown more aggressive in targeting U.S. Defense Department civilians, even though they too are in the country under the SOFA, which is intended to protect them from double taxation, Albrecht said.

Going after active-duty troops, at least until now, has been almost unheard of, Albrecht said.

However, it’s possible that active-duty troops have been snared by tax authorities but haven’t sought outside help.

U.S. Army Europe, which is in charge of SOFA issues for the military in Germany, said it does not track how many troops or other personnel have been forced to pay German taxes.

USAEUR’s Office of the Judge Advocate also said the command “disputes the German interpretation of the SOFA and has brought its arguments forward to the German Foreign Ministry.”

But Albrecht said the issue remains pressing for his clients.

“The reason we have this problem is the political action on the U.S. side is not strong enough,” he said.

At issue is Article 10 of the SOFA treaty, which establishes an exemption from German taxation for personnel who are in Germany “solely” because of their jobs.

Historically, military orders for service members and civilians were sufficient proof for the tax exemption. But German tax authorities have begun interpreting “solely” in different ways.

Now, a key question is whether military members intend to return to the United States.

Personnel stationed in Germany for many years – there is no standard for just how many – or with significant ties such as being married to a German, owning property, sending children to German schools or even extending tours could call SOFA status into question, U.S. military officials in Europe said.

Such circumstances “may result in German authorities alleging the DoD member intends to reside in Germany permanently and therefore must pay income taxes due,” U.S. Air Forces Europe said in a statement.

Once in the German legal system, the burden of proof is on the individual claiming tax exemption, USAFE said.

The problem is connected to a 2007 revision in the U.S.- German tax treaty on double taxation, which opened the door to full taxation of U.S. government pay if German authorities decide SOFA status doesn’t apply, USAFE said.

Keeping off the radar

USAREUR is advising service members to take preventive measures to stay off the radar of German tax authorities. For example, do not register for residency with a local German town hall.

“Doing so will trigger a German tax ID number,” USAREUR said in a statement.

Also, do not file a joint German tax return with a German spouse, which indicates to the German government a desire to be taxed like an ordinary resident, the Army said.

German spouses should avoid changing their tax class after getting married, because it signals to tax offices that they need to probe the other spouse’s reasons for being in Germany, the Army said.

Albrecht said he has seen cases involving military civilians occur in most areas where there are bases. However, the Kusel tax office, not far from Ramstein, has proven to be the most aggressive, he said.

“If a willingness to return cannot be proven, the income of US soldiers in Germany is taxable,” Leismann, the spokesman for the Kusel-Landstuhl finance office, said in a statement.

The financial stakes for the military community can be high. Albrecht has a civilian client who lives in the Mannheim area faced with an 80,000 euro tax bill. Part of that came from tax officials factoring in privileges like less expensive on-base gas, access to post exchanges and even cheaper cigarettes.

”The German side has the opinion this is income and they tax the privileges, which they say is about $15,000 per year,” Albrecht said.

In the past, German courts have on occasion ruled in favor of Americans with military connections.

In 2007, three American contractors were reimbursed hundreds of thousands of euros each in German income taxes they were forced to pay by the Kaiserslautern tax office, after a victory in Rheinland-Pfalz state finance court.

Albrecht said he is confident Larsen, the airman, also would be victorious if the case goes to court.

But Larsen says that’s a fight he shouldn’t be forced into, and that U.S. military leaders should take a more aggressive stance in supporting personnel being targeted.

“The stress of this is unbelievable,” Larsen said.

Translation of an article in the german newspaper "DIE RHEINPFALZ":

13 October 2020

In the clinch with the "Inquisitor"

U.S. military personnel is exempt from local taxes in Germany. Theoretically. For years, however, cases have been piling up in which the German treasury wants to recognize exceptions. A flood of lawsuits is looming, warns a lawyer in Kaiserslautern. He represents dozens of U.S. military members living in the Palatinate.

By Ilya Tüchter

“Courage will endure” - Bravery will survive. This is the motto of the 86th U.S. Air Force Transport Squadron. It is stationed in Ramstein. From there, it ensures that the US can use its military power throughout Europe and the Middle East. Whether in the Cold War or in battles in the Persian Gulf, the US servicemembers stationed in the Palatinate are prepared for battle and victory.

For some time now, however, they have had an opponent that many of them truly fear: the Kusel-Landstuhl tax office. According to research by the US military newspaper “Stars & Stripes”, 387 members of the American communities in the Kaiserslautern area have trouble with the German treasury. This is despite the fact that the NATO Status of Forces Agreement of 1951 stipulates that the salaries and emoluments of US military personnel stationed in Germany are taxed only in their home country. This applies to active members of the U.S. forces, the civilian entourage, and their dependents as long as they are U.S. citizens.

“This is a threat to many people's livelihoods,” says Detlev Albrecht. The K-Town lawyer specializes in tax law and represents US Americans against the Treasury. It involves sums ranging from EUR 50,000 to EUR 300,000. The alleged tax debt is calculated going back up to ten years and marked as due. Albrecht's lawsuits go before the Rhineland-Palatinate Tax Court in Neustadt and also before to the Federal Tax Court in Munich. Forty cases are currently underway for members of the US military community, as he explains to the RHEINPFALZ in his office in the City Center of K-Town. In the cupboards and even on the floor there are long rows of ring binders.

Eagerly female caseworker

Wrestling is nothing new. Already in the last decade, the Federal Tax Court had to deal with the issue whether there could be exceptions to the NATO Status of Forces Agreement. To put it bluntly, German tax law sometimes trumps international law. Also in Stuttgart, Wiesbaden, Bitburg-Prüm – important US sites, too – members of the American military are engaged in legal battles with the treasury. According to Attorney Albrecht's impression, the Kusel-Landstuhl tax office is recently proceeding with particular force and, according to the 65-year-old, "dubious reasons" that must finally be clarified by the highest court – from his point of view: smashed. Or just politically regulated. Otherwise, there is a threat of a “flood of endless lawsuits,” said Albrecht, who has represented clients in such cases for 20 years and whose assessment is that “the tax offices violate the NATO Status of Forces Agreement, and they think they can interfere with American tax law.”

Among US military personnel “inquisitor” is the nickname of a female caseworker who is said to be particularly eager. The tax office in Kusel declined to comment directly to RHEINPFALZ and referred instead to the Ministry of Finance in Mainz.

A ministry spokeswoman confirms that “in recent years there have been increasing cases of doubt,” which is why “the tax offices are accordingly sensitized regarding the tax liability of US servicemembers in Germany.” And yes: “There are cases where (former) members of the US Forces, the civilian component, and their dependents are liable for income tax in Germany.” The issue is whether or not the so-called “non-residential fiction” applies. This refers to whether an American is in Germany solely because of his duties with the US military or if there are other reasons for his stay from which a tax liability could be inferred: “Members of the US Forces stationed in county are subject to unlimited tax liability if they are either German citizens or are also in Germany for reasons other than their work for the US Forces.”

Any exceptions would then be governed by the Tax Treaty of 2006 between the USA and Germany. “Whether the conditions for a tax exemption under NATO Status of Forces Agreement exist or not, has to be examined by the tax offices under their own responsibility," the ministry spokeswoman added. “Marriage to a spouse residing and working in Germany” is considered to be an indication here. The spokeswoman did not want to be more specific.

According to Attorney Albrecht, there is a kind of “watch list” that is used to justify an alleged tax liability of US military personnel: “For example, when an American is married to a German. Or there are still children, or the spouses may even own a condominium." All of this, Albrecht emphasizes, should not matter in itself. The only decisive factor for a tax exemption under the NATO Status of Forces Agreement was the stationing by the US government. So the status at the time of entry into Germany. With the marching order, a return intention is implied, so to speak. It is only the date of the stationing or employment by the US military that counts for the assessment of residence, Albrecht refers to an internal agreement of the German higher tax authorities of 2013, which is also available to RHEINPFALZ. It states: “Later changes thereafter are irrelevant.” Apart from that, Albrecht argues: How does the tax office want to prove that someone does not want to return to the USA?

U.S. State Department active

Given the already tense German-American relations in the Donald Trump era, and the military and economic importance of the US presence to the Federal Republic, the question arises as to where politics remains. In Mainz, the state government states: “To our knowledge, there are currently no discussions between the state government and the US government on this issue.” Interior Minister Roger Lewentz (SPD), who even travels regularly to the USA to discuss the US presence in Rhineland-Palatinate in Washington in government and parliament, is also not involved. His spokesman said: “The issue has not yet been a topic in discussions between Minister Lewentz and representatives of the US Armed Forces.”

A small question by CDU parliamentarians Marlies Kohnle-Gros and Marcus Klein in the spring shows, however, that the government in Mainz knows well. For example, an information event for Americans on German tax issues was organized through the Atlantic Academy in Kaiserslautern. “The issue has become more topical and is being discussed more widely on social media among military personnel,” Academy Director David Sirakov told RHEINPFALZ when asked. The Federal government is definitely in the picture. According to the Foreign Office in Berlin, the Ministry is aware “that the interpretation of Article X of the Agreement between the parties to the North Atlantic Treaty (...) and the question of the tax liability of members of the force, as laid down in that provision, was and is the subject of tax court proceedings and tax administrative procedures.” Details of the progress were not known to the Foreign Office.

A spokesman for the US Embassy was also reluctant, but spoke of a “long-standing issue.” They are working on this “in concert” and believe it is a “misinterpretation” of NATO Status of Forces Agreement: “The (US) Ministry of Defense and the State Department are busy trying to reach a solution.”

Controversy over cheap gas

Until then, the proceedings are going their legal way. For example, Attorney Albrecht has brought proceedings before the Federal Tax Court concerning a particularly complicated sub-chapter of this tax dispute: benefits received by members of the US military community, which the German tax office would like to tax. It is about, for example, discounted cigarettes or gas, but also the free use of sports facilities such as a golf course. In the case of a technical expert with the US military, represented by Albrecht, it is a monetary benefit, says the treasury. Yes, but not to be tax-wise considered by the German treasury, says Attorney Albrecht. These are “status related benefits” that are solely a matter for the US government or American taxpayers.

Nevertheless, the tax office usually simply adds a flat rate of 18,000 euros per year. “Whether someone is a non-smoker or does not play golf at all is not taken into account,” Albrecht criticizes. It is unclear when the Federal Tax Court will deal with his latest submission. The court did not respond to a request from RHEINPFALZ.

One of the US servicemembers represented by Albrecht is Matthew Larsen, about whom the RHEINPFALZ in Kusel has already reported. Larsen is married to a German and, according to the treasury, is partially taxable here. His client would win in court, Albrecht is sure. “This is a fight I shouldn't be forced into,” says the Master Sergeant stationed in Ramstein. But he will probably have to remain brave.

US embassy to challenge Germany over attempts to tax American troops

STUTTGART, Germany — Germany is violating an international treaty when it asks U.S. military personnel to pay taxes in the country, the U.S. Embassy in Berlin said as it jumped into a long-running fiscal dispute that has affected hundreds of U.S. troops and civilians.

The U.S. Embassy and military commands “are aware of this long-standing issue and working closely in concert to address what we believe to be a misinterpretation of the NATO Status of Forces Agreement,” embassy spokesman Joseph Giordono-Scholz said in a statement this week.

“The Department of Defense and Department of State are engaged to try and reach a resolution,” Giordono-Scholz said, giving the first indication that the issue is being tackled at a higher level than military commands in Germany, which have been unable to resolve it after years of trying.

State and Defense Department lawyers are hashing out the details of a plan that will be turned over to the embassy for action in the weeks ahead, a State Department official told Stars and Stripes this week.

The involvement of senior U.S. officials comes after Stars and Stripes earlier this year spotlighted how Germany has threatened to impose hefty tax penalties — some in six figures — on troops and civilians who it says have special ties to the country. It’s aimed at getting the German federal government to issue guidance that would stop regional tax offices from levying taxes on Americans living in the country with SOFA protections, military officials have said.

The NATO Status of Forces Agreement is intended, among other things, to protect military personnel, who already pay taxes in the U.S., from having to also pay it in Germany on their military pay.

But some local fiscal offices in Germany maintain they have a right to tax personnel who aren’t in the country “solely” for their jobs.

They have argued that a service member or Defense Department civilian who extends their tour, marries a local person or does anything else that suggests special ties to Germany could be liable for taxes on all military pay they’ve received while in Germany, including back pay. Benefits such as housing allowance have been factored into the tax bills, said tax experts and a German defense attorney who has taken on some military cases.

To avoid being taxed, service members and civilians must prove to German authorities a “willingness to return” to the U.S. But there is no established legal standard that defines what constitutes a willingness to return and German tax offices decide on a case-by-case basis if they will waive or impose taxes on someone.

The ultimate proof of intent to leave — actually returning to the U.S. — doesn’t necessarily offer protection from German regional finance offices, which have sought taxes dating back 10 years and pursued U.S. personnel after they have returned home.

U.S. Army Europe, which manages SOFA matters in Germany, has known about the severity of the problem since at least 2014, when an Army PowerPoint presentation about host-nation relations noted that around 100 civilians and active-duty troops were in financial difficulty after receiving tax bills from the Germans.

Today, nearly 500 people with military ties are under investigation in the Landstuhl area, where thousands of Americans who are assigned to Ramstein Air Base and several Army bases live, the local tax office said in July. Military members in other regions, including Stuttgart and Wiesbaden, also have been targeted.

In the 2014 document, USAREUR said the personal nature of the issue meant “the ability of the command to influence the outcome is limited.”

It also said that, as a “last resort,” the U.S. Embassy in Berlin could be called in to organize “inter-governmental talks” on the issue.

It’s unclear if the growing number of Americans with SOFA status who are being threatened with tax bills was the trigger for that last-resort solution, but six years later, the high-level talks seem to be on the brink of happening.

vandiver.john@stripes.com

Twitter: @john_vandiver